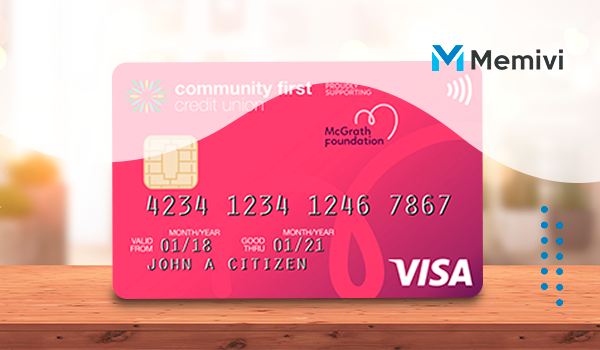

Discover a new level of financial flexibility and style with the Low Rate Pink Credit Card! Designed for those who seek to combine practicality with a touch of elegance, this card offers an unbeatable low interest rate that makes managing your finances a breeze. Whether you’re looking to make everyday purchases or handle larger expenses, the Low Rate Pink Credit Card is here to offer you both convenience and sophistication.

Embrace the benefits of a card that not only provides a low rate but also comes with a range of features tailored to your needs. With its striking pink design, this card adds a touch of flair to your wallet while delivering exceptional value.

Low Rate Pink Visa Benefits

- Low Interest Rates: Enjoy the advantage of some of the lowest interest rates available with the Low Rate Pink Credit Card. This means you can carry a balance with confidence, knowing that you’ll incur minimal interest charges. It’s an ideal choice for those looking to save money while managing their credit.

- Low Annual Fee: Enjoy the benefits of your card with a modest $50 annual fee. This affordable fee ensures you can access all the card’s features and rewards without breaking the bank.

- Flexible Credit Limits: Benefit from flexible credit limits that cater to your spending needs. Whether you’re managing everyday expenses or handling larger purchases, the Low Rate Pink Credit Card adjusts to fit your financial requirements.

- Online Account Management: Stay on top of your finances with easy online account management. Access your account, track your spending, and make payments effortlessly through the card’s online portal, giving you complete control over your financial activities.

- Travel and Emergency Assistance: Travel with confidence knowing the Low Rate Pink Visa provides travel and emergency assistance services! Whether you’re facing a travel emergency or need help while on the go, this card offers valuable support to ensure a smooth and stress-free experience!

- Fraud Protection: Shop with confidence knowing that the Low Rate Pink Visa offers robust fraud protection! With advanced security features, your purchases are safeguarded against unauthorized transactions. Enjoy peace of mind and secure your finances with this reliable card!

- 24/7 Customer Service: Benefit from round-the-clock support with the Low Rate Pink Visa’s 24/7 customer service! Whether you have questions about your account or need assistance, help is always just a call away. Experience top-notch service anytime you need it!

- Flexible Payment Options: Experience the convenience of flexible payment options with the Low Rate Pink Visa! Choose the payment plan that best fits your budget and lifestyle. Whether you prefer to pay off your balance in full or carry a balance with low interest, this card adapts to your financial needs!

- Take Advantage of Enticing Introductory Offers: Dive into the world of savings with introductory offers that give you a head start from the moment you sign up! Whether it’s 0% APR on balance transfers, bonus rewards, or cash back, these limited-time deals are designed to maximize your financial benefits right from the beginning. With these exciting offers, you’ll enjoy enhanced savings, reduced interest costs, and extra perks that make your credit card experience even more rewarding. Don’t miss out on these fantastic opportunities to get the most out of your new card and set yourself up for financial success!

Who Can Apply?

To apply for the Low Rate Pink Credit Card, you typically need to meet the following criteria:

- Age: Must be at least 18 years old.

- Income: Have a stable income that meets the card’s minimum requirement.

- Credit History: Maintain a good credit history with a responsible credit behavior.

- Residency: Be a resident of the country where the card is issued.

How to Apply?

- Check Eligibility: Ensure you meet the age, income, and credit history requirements.

- Gather Documents: Prepare necessary documents such as proof of income and identification.

- Fill Out Application: Complete the online application form or visit a local branch.

- Submit Application: Submit your application for review.

- Await Approval: Wait for approval and receive your card details upon acceptance.

Low Rate Pink Visa Frequently Asked Questions

- What is the interest rate on the Low Rate Pink Credit Card?

- The card offers some of the lowest interest rates available. For the exact rate, refer to the cardholder agreement or contact customer service.

- How can I check my rewards balance?

- Log into your online account or use the mobile app to view your rewards balance.

- What is the credit limit for this card?

- Credit limits are flexible and vary based on your financial profile and creditworthiness.

- How do I manage my account online?

- Access your account through the card’s online portal or mobile app to manage your account, track spending, and make payments.

The Destiny Mastercard <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Rebuild, Refresh, and Rise — A Simple Way to Take Back Your Financial Confidence </p>

The Destiny Mastercard <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Rebuild, Refresh, and Rise — A Simple Way to Take Back Your Financial Confidence </p>  In-Depth Review: The Chase Sapphire Preferred Card <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Dive into an in-depth review that reveals everything you need to know about the subject </p>

In-Depth Review: The Chase Sapphire Preferred Card <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Dive into an in-depth review that reveals everything you need to know about the subject </p>  Pay It Off Fast: Your Guide to Crushing Credit Card Debt <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Pay It Off Fast is a powerful strategy that many overlook on their journey to financial freedom </p>

Pay It Off Fast: Your Guide to Crushing Credit Card Debt <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Pay It Off Fast is a powerful strategy that many overlook on their journey to financial freedom </p>