The U.S. Bank Smartly Visa Signature Credit Card is built for consumers who value straightforward rewards, no fees, and the flexibility to enhance earnings through their relationship with U.S. Bank. With a flat 2% cash back on all purchases—and up to 4% for customers with qualifying bank balances—this card stands out as one of the most lucrative fixed-rate options on the market.

💰 Why Choose the U.S. Bank Smartly Card?

- 2% Unlimited Cash Back: Automatically earn 2% cash back on every purchase—no rotating categories, no activation, no cap.

- Up to 4% Back for Bank Clients: Earn higher rates based on qualifying deposit balances held with U.S. Bank:

- 2.5% for balances of $10,000–$49,999

- 3% for balances of $50,000–$99,999

- 4% for balances of $100,000+

- $0 Annual Fee: Keep more of your rewards without worrying about offsetting a yearly charge.

- 0% Intro APR: Enjoy 12 months of 0% APR on purchases and balance transfers—ideal for financing big expenses or consolidating.

- Multiple Redemption Options: Redeem your cash back as statement credit, direct deposit to a U.S. Bank account, or as gift cards and travel rewards.

- Cell Phone Protection: Pay your phone bill with the card and get automatic coverage for theft or damage.

This card is especially appealing for high-balance banking clients—but even without that status, the base 2% rate is strong.

👤 Best Fit for This Card

- U.S. Bank Account Holders: If you already bank with U.S. Bank and keep a sizable balance, this card lets you extract more value from your deposits.

- Cash Back Maximizers: Prefer a fixed-rate card that requires no tracking or rotating categories.

- People Who Want Simplicity: It’s perfect for anyone who wants consistent rewards without management headaches.

- Big Spenders in All Categories: If your spending doesn’t fall neatly into categories, a 2% flat rate delivers across the board.

📊 U.S. Bank Smartly vs. Citi Double Cash

| Feature | U.S. Bank Smartly | Citi Double Cash |

| Base Cash Back | 2% | 2% (1% when buying, 1% when paying) |

| Max Cash Back | 4% with U.S. Bank assets | 2% |

| Annual Fee | $0 | $0 |

| Intro APR | 0% for 12 months | 0% for 18 months |

| Redemption Flexibility | Yes | Yes |

| Bank Account Synergy | Strong | None |

Citi Double Cash offers simplicity and slightly longer intro APR, but Smartly delivers double the cash back potential if you qualify for U.S. Bank’s upper tiers.

🤔 Is the U.S. Bank Smartly Worth It?

If you’re already banking with U.S. Bank—or willing to move funds to qualify for bonus rates—the Smartly Visa Signature is a top-tier cash back card. The 2% base rate is competitive, and the ability to earn 3% or 4% with no extra effort puts this card ahead of many so-called premium options.

It’s ideal for people who want consistent, easy-to-redeem rewards across all spending, with the added bonus of banking integration. Even without the boosted rates, the no-fee structure, APR intro period, and strong redemption options make this card worth considering for any user looking for dependable cash back.

👉 Curious how to qualify for the top 4% cash back tier or how to apply online? Turn to the next page for a complete guide.

U.S. Bank Cash+ Visa Signature Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The U.S. Bank Cash+ Visa Signature Card is packed with features designed to provide exceptional, personalized value and a user-friendly experience. </p>

U.S. Bank Cash+ Visa Signature Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The U.S. Bank Cash+ Visa Signature Card is packed with features designed to provide exceptional, personalized value and a user-friendly experience. </p>  BankAmericard Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> This card is all about giving you the breathing room you need to make real progress on your financial goals. </p>

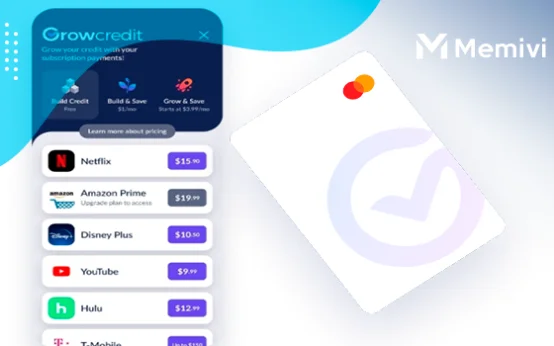

BankAmericard Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> This card is all about giving you the breathing room you need to make real progress on your financial goals. </p>  Grow Credit Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Grow Credit offers a straightforward and accessible path to building a positive credit history, one monthly subscription at a time. </p>

Grow Credit Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Grow Credit offers a straightforward and accessible path to building a positive credit history, one monthly subscription at a time. </p>