The Capital One Venture Rewards Credit Card is one of the most well-known travel credit cards in the U.S. market. It’s designed for people who want to earn travel rewards without dealing with complex point systems or rotating categories. Whether you’re planning your next vacation or just want to earn travel perks on everyday purchases, this card delivers consistent value and a smooth user experience.

Its main appeal lies in its flat-rate rewards, where every dollar you spend earns 2 miles, no matter the category. Plus, the miles are easy to redeem—whether it’s for flights, hotels, or even statement credits. With a strong welcome bonus and built-in travel protections, it competes well with higher-fee cards.

✅ Main Benefits of the Capital One Venture Rewards Credit Card

- Unlimited 5X miles on Capital One Travel.

- Unlimited 2X miles on every purchase, every day

- 75,000 miles welcome bonus after spending $4,000 in the first 3 months

- $95 annual fee that’s easily offset by rewards

- No foreign transaction fees

- Global Entry or TSA PreCheck credit (up to $100)

- Flexible redemption options for travel, gift cards, and more

- Travel accident insurance and 24/7 travel assistance services

🏆 Comparison Table: Capital One Venture vs. Competitors

| 🔍 Feature | 💳 Capital One Venture | 💳 Chase Sapphire Preferred |

| 🎁 Rewards Rate | 2X miles on all | 2X points on travel/dining |

| 💰 Annual Fee | $95 | $95 |

| 📨 Welcome Bonus | 75,000 miles | 60,000 points |

| ✈️ Travel Credits | TSA PreCheck/Global Entry | None |

| 🛍️ Redemption Flexibility | High | High |

💡Is the Capital One Venture Credit Card Really Worth It?

If you value simplicity, flexibility, and consistent travel rewards, the Capital One Venture Card is definitely worth considering. While many travel cards offer elevated rewards in rotating or specific categories—like dining, groceries, or gas—the Venture Card keeps things straightforward with an unlimited 2X miles on every purchase, every day.

This flat-rate structure is ideal for people who prefer not to juggle multiple cards or keep track of spending categories to optimize their rewards. Whether you’re booking flights, shopping online, or paying your monthly bills, you’re earning valuable miles without the hassle.

The $95 annual fee is relatively modest when compared to the benefits packed into this card. New cardholders can earn a generous welcome bonus after meeting the minimum spend requirement, which can offset the fee in the first year alone. Additionally, perks like travel accident insurance, auto rental collision coverage, and no foreign transaction fees add real value, especially if you’re a frequent traveler. One standout feature is the up to $100 statement credit for Global Entry or TSA PreCheck—a must-have for anyone who flies often and wants to speed through security or customs.

In summary, the Capital One Venture Card strikes a smart balance between value and simplicity, making it a strong contender for travelers who want solid rewards on all purchases without having to overthink their spending strategy.

U.S. Bank Cash+ Visa Signature Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The U.S. Bank Cash+ Visa Signature Card is packed with features designed to provide exceptional, personalized value and a user-friendly experience. </p>

U.S. Bank Cash+ Visa Signature Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The U.S. Bank Cash+ Visa Signature Card is packed with features designed to provide exceptional, personalized value and a user-friendly experience. </p>  BankAmericard Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> This card is all about giving you the breathing room you need to make real progress on your financial goals. </p>

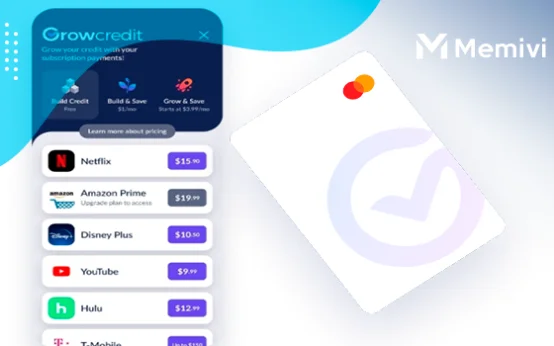

BankAmericard Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> This card is all about giving you the breathing room you need to make real progress on your financial goals. </p>  Grow Credit Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Grow Credit offers a straightforward and accessible path to building a positive credit history, one monthly subscription at a time. </p>

Grow Credit Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Grow Credit offers a straightforward and accessible path to building a positive credit history, one monthly subscription at a time. </p>