The Upgrade Visa Card with Cash Rewards stands out by combining the convenience of a credit card with the structured repayment of a personal loan. Designed for individuals aiming to build or rebuild their credit, this card offers a straightforward 1.5% cash back on all purchases and no annual fee.

Its unique approach allows cardholders to make purchases and then repay them in fixed monthly installments, promoting responsible spending habits. With credit lines ranging from $500 to $25,000, it’s a versatile tool for managing everyday expenses and larger purchases alike.

What are the Best Cards in the US?

Why we recommend the Upgrade Visa Card

The Upgrade Visa Card is tailored for individuals seeking a balanced approach to credit. Its hybrid nature combines the flexibility of a credit card with the discipline of installment loans, allowing users to make purchases and repay them over time with fixed monthly payments. This structure not only aids in budgeting but also helps in avoiding the pitfalls of revolving debt.

One of its standout features is the unlimited 1.5% cash back on all purchases, which is applied as a statement credit when payments are made. This incentivizes timely payments and reduces the overall cost of purchases. Additionally, the card boasts no annual fee, making it a cost-effective choice for many.

The card’s credit lines, ranging from $500 to $25,000, cater to a broad spectrum of credit profiles. Moreover, Upgrade reports to all three major credit bureaus, facilitating credit building or rebuilding efforts. The application process includes a soft credit check for prequalification, ensuring that potential applicants can assess their eligibility without impacting their credit score.

Overall, this card is a solid choice for those aiming to manage their finances responsibly while reaping the benefits of cash back rewards.

How can the Upgrade Visa Card be used?

Everyday Spending and Budgeting

The Upgrade Visa Card with Cash Rewards is ideal for everyday purchases, from groceries and gas to online shopping and utility bills. Its widespread acceptance wherever Visa is recognized ensures seamless transactions.

What sets this card apart is its repayment structure: instead of revolving balances, purchases are consolidated into installment plans with fixed monthly payments. This approach promotes disciplined spending and simplifies budgeting, as users know exactly how much they owe each month.

The 1.5% cash back on all purchases is automatically applied as a statement credit when payments are made, effectively reducing the cost of purchases and encouraging timely repayments. This feature not only rewards spending but also fosters responsible financial behavior.

Credit Building and Financial Management

For individuals aiming to build or rebuild their credit, the Upgrade Visa Card offers significant advantages. By reporting to all three major credit bureaus, it ensures that consistent, on-time payments positively impact credit scores.

The card’s structure, which avoids revolving debt, helps maintain low credit utilization ratios, a key factor in credit scoring models.

Additionally, the card’s user-friendly online platform and mobile app provide tools for tracking spending, managing payments, and monitoring account activity. These resources empower users to stay on top of their finances, set payment reminders, and make informed financial decisions.

The combination of structured repayments, cash back rewards, and credit reporting makes this card a valuable asset for those committed to improving their financial health.

Advantages of the Upgrade Visa Card

- No annual fee

- Unlimited 1.5% cash back on all purchases

- Structured repayment plans with fixed monthly payments

- Credit lines ranging from $500 to $25,000

- Reports to all three major credit bureaus

- Soft credit check for prequalification

- User-friendly online and mobile account management

- No penalty APRs or hidden fees

- Visa acceptance worldwide

- Encourages responsible spending and budgeting

Disadvantages of the Upgrade Visa Card

While the Upgrade Visa Card offers numerous benefits, it’s important to consider potential drawbacks. The fixed installment repayment structure may not suit those who prefer the flexibility of traditional revolving credit cards.

Additionally, the card lacks introductory APR offers, which some competitors provide. Cash back rewards are only applied when payments are made, rather than at the time of purchase.

Lastly, the maximum credit limit may be lower than some premium credit cards, potentially limiting purchasing power for high spenders.

How credit analysis is carried out

Upgrade employs a two-step credit evaluation process. Initially, a soft credit check is conducted during prequalification, allowing applicants to assess eligibility without impacting their credit score. Upon proceeding with the full application, a hard credit inquiry is performed.

Approval decisions are based on various factors, including credit history, income, debt-to-income ratio, and overall financial health, ensuring a comprehensive assessment of each applicant’s creditworthiness.

Is there a maximum and minimum limit for the Upgrade Visa Card?

Yes, the Upgrade Visa Card offers credit lines ranging from $500 to $25,000, depending on the applicant’s credit profile and financial situation. The minimum credit limit of $500 ensures accessibility for individuals with fair credit, while the maximum limit caters to those with stronger credit histories and higher incomes.

Upgrade periodically reviews accounts for potential credit line increases based on responsible usage and payment history. However, it’s important to note that credit limits are not guaranteed to increase and are subject to Upgrade’s discretion.

Maintaining good credit habits can enhance the likelihood of receiving higher credit limits over time.

Want to apply? Learn how to get the Upgrade Visa Card right here:

Continue to the next page to discover the step-by-step application process, eligibility requirements, and tips for maximizing your chances of approval.

U.S. Bank Cash+ Visa Signature Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The U.S. Bank Cash+ Visa Signature Card is packed with features designed to provide exceptional, personalized value and a user-friendly experience. </p>

U.S. Bank Cash+ Visa Signature Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The U.S. Bank Cash+ Visa Signature Card is packed with features designed to provide exceptional, personalized value and a user-friendly experience. </p>  BankAmericard Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> This card is all about giving you the breathing room you need to make real progress on your financial goals. </p>

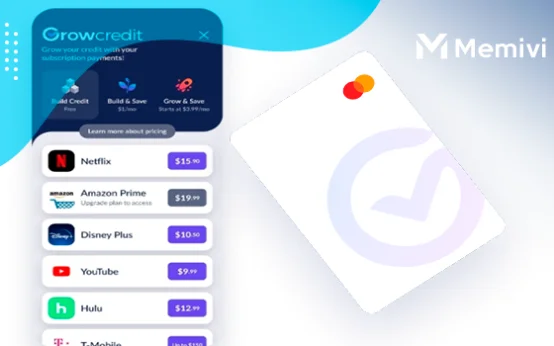

BankAmericard Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> This card is all about giving you the breathing room you need to make real progress on your financial goals. </p>  Grow Credit Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Grow Credit offers a straightforward and accessible path to building a positive credit history, one monthly subscription at a time. </p>

Grow Credit Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Grow Credit offers a straightforward and accessible path to building a positive credit history, one monthly subscription at a time. </p>