Navigating the complexities of modern finance often requires the right tools, and a dependable credit card is one of the most essential.

The Chime Credit Card emerges as an exceptional choice, providing a suite of features aimed at streamlining financial management and enhancing reward opportunities. Here’s a closer look at why the Chime Credit Card is highly regarded among informed consumers.

The Smart Way to Build Credit with No Fees

Pros

- No credit check required – Get approved without worrying about your credit score.

- No annual fees or interest – Save money while building credit.

- No minimum security deposit – Use your own money to set a spending limit.

- Reports to all three major credit bureaus – Helps improve your credit score faster.

- No preset credit limit – You control your spending, making it easy to manage.

- Seamless integration with Chime Spending Account – Move money effortlessly.

- Safe and secure – Get real-time alerts and protection against fraud.

Cons

- Limited Rewards Program: This card focuses on credit-building, not perks.

- Account Eligibility Requirements: You must have a Chime account to use this card.

Why Should You Consider This Credit Card?

The Chime Visa Credit Card, despite a few drawbacks, shines with its straightforward approach and exceptional value. It’s designed for ease of use, featuring a fee-free model, immediate rewards, and tools to help you build credit. Combined with real-time transaction alerts, it simplifies your financial management.

If you’re seeking a card that offers a clear path to financial growth and streamlined banking, the Chime Credit Card is worth considering. Apply now and discover how it can enhance your financial experience.

U.S. Bank Cash+ Visa Signature Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The U.S. Bank Cash+ Visa Signature Card is packed with features designed to provide exceptional, personalized value and a user-friendly experience. </p>

U.S. Bank Cash+ Visa Signature Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The U.S. Bank Cash+ Visa Signature Card is packed with features designed to provide exceptional, personalized value and a user-friendly experience. </p>  BankAmericard Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> This card is all about giving you the breathing room you need to make real progress on your financial goals. </p>

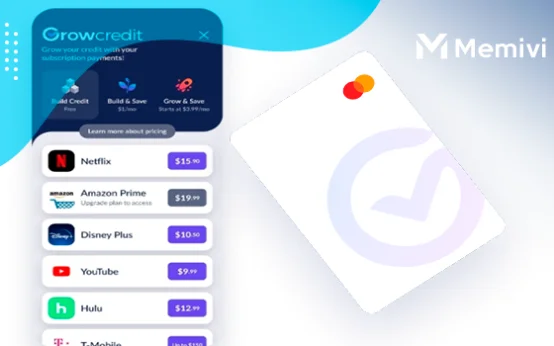

BankAmericard Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> This card is all about giving you the breathing room you need to make real progress on your financial goals. </p>  Grow Credit Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Grow Credit offers a straightforward and accessible path to building a positive credit history, one monthly subscription at a time. </p>

Grow Credit Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Grow Credit offers a straightforward and accessible path to building a positive credit history, one monthly subscription at a time. </p>