Designed for those who value both versatility and value, the Reflex Platinum card offers a range of benefits that make everyday spending more rewarding and enjoyable. From earning cash back to enjoying flexible rewards, the Reflex Credit Card is crafted to enhance your financial lifestyle with ease and excitement.

Whether you’re managing your daily expenses or planning a special purchase, the Reflex Credit Card empowers you with benefits that fit your needs. Embrace the joy of earning rewards on every purchase and enjoy the flexibility of redeeming them in ways that matter most to you. Discover how the Reflex Credit Card can transform your financial journey and make every swipe a step toward greater rewards!

Reflex Platinum Mastercard Benefits

- Build or Rebuild Credit: Take charge of your financial future with the Reflex Platinum Mastercard! This card is perfect for those looking to build or rebuild their credit. By using the card responsibly and making on-time payments, you’ll be on your way to a stronger credit profile. It’s your chance to shine in the world of credit!

- Monthly Reporting to Credit Bureaus: Watch your credit score soar as the Reflex Platinum Mastercard reports your activity to all three major credit bureaus! Each responsible payment you make boosts your credit profile and helps you establish a solid credit history. It’s like having a personal cheerleader for your credit journey!

- Access to a Higher Credit Limit: Enjoy the freedom and flexibility of a higher credit limit with the Reflex Platinum Mastercard! As you demonstrate responsible credit use, you may qualify for increased credit limits, giving you more purchasing power and financial flexibility. It’s all about rewarding your responsible behavior!

- Fraud Protection: Stay secure with advanced fraud protection features. The Reflex Credit Card provides robust security measures to safeguard your account and personal information, giving you peace of mind while you shop and travel.

- Purchase Protection: Benefit from purchase protection that covers damage or theft of eligible items. Shop confidently, knowing that your purchases are safeguarded and you can resolve any issues that arise.

- Travel Benefits: Take advantage of travel benefits, including travel insurance and emergency assistance services. The Reflex Credit Card is designed to support your adventures and ensure that you’re covered while on the go.

- Access to 24/7 Customer Service: Experience the convenience of 24/7 customer service with the Reflex Platinum Mastercard! Whether you have questions, need assistance, or just want to manage your account, help is always just a phone call away. It’s all about making your credit experience as smooth as possible!

- Online Account Management: Stay in control of your finances with easy online account management! The Reflex Platinum Mastercard offers a user-friendly online portal where you can check your balance, view transactions, and manage your account anytime, anywhere. It’s all about giving you the tools to manage your credit effortlessly!

The Reflex Platinum Mastercard combines practical benefits with a focus on building and maintaining good credit, making it a valuable addition to your financial toolkit!

Who Can Apply?

To apply for the Reflex Credit Card, you typically need to meet the following criteria:

- Age: Must be at least 18 years old.

- Income: A stable source of income is required, with specific minimum income thresholds varying by issuer.

- Credit History: A good credit history is preferred, though options may be available for those with varying credit profiles.

- Residency: Must be a resident of the country where the card is issued.

How to Apply?

- Visit the Application Page: Go to the Reflex Credit Card application page on the issuer’s website.

- Complete the Form: Fill out the application form with your personal and financial details.

- Submit Documentation: Provide any required identification and proof of income.

- Review and Submit: Review your application for accuracy and submit it for processing.

- Await Approval: Wait for the approval decision and receive your Reflex Credit Card if approved.

Frequently Asked Questions

Does the Reflex Platinum Mastercard have an annual fee?

Yes, the card does charge an annual fee, which varies depending on your credit profile. The fee typically ranges from $75 to $125 for the first year and $99 to $125 annually after that.

Are there foreign transaction fees with the Reflex Credit Card?

Yes, this card charges a foreign transaction fee of up to 3% of the total purchase amount when you use the card outside the U.S. or shop online from an international merchant.

What are the interest rates (APR) for this credit card?

The APR for purchases and cash advances can range from 29.99% to 36% variable, which is on the higher side. To avoid paying high interest, it’s best to pay off your balance in full each month.

How can I request a credit limit increase?

Your account will be automatically reviewed for a credit limit increase after six months of on-time payments. If eligible, your limit could double without needing to request it manually.

U.S. Bank Cash+ Visa Signature Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The U.S. Bank Cash+ Visa Signature Card is packed with features designed to provide exceptional, personalized value and a user-friendly experience. </p>

U.S. Bank Cash+ Visa Signature Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The U.S. Bank Cash+ Visa Signature Card is packed with features designed to provide exceptional, personalized value and a user-friendly experience. </p>  BankAmericard Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> This card is all about giving you the breathing room you need to make real progress on your financial goals. </p>

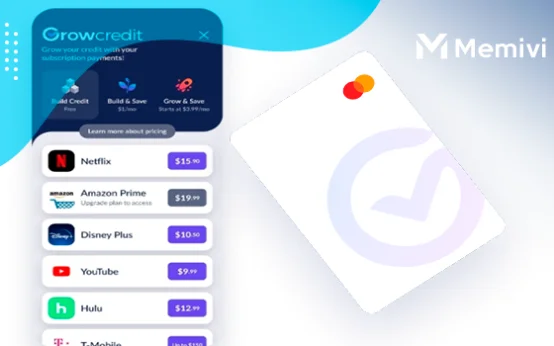

BankAmericard Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> This card is all about giving you the breathing room you need to make real progress on your financial goals. </p>  Grow Credit Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Grow Credit offers a straightforward and accessible path to building a positive credit history, one monthly subscription at a time. </p>

Grow Credit Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Grow Credit offers a straightforward and accessible path to building a positive credit history, one monthly subscription at a time. </p>